FeeCollect

FeeCollect allows you to deduct professional fees directly from your client's tax refund.

FeeCollect is not available for use in conjunction with any other Settlement Solutions.

Before you can use the FeeCollect service, you must enroll your Electronic Filing Identification Number (EFIN).

For frequently asked questions about FeeCollect, visit www.support.atxinc.com/feecollect/ESPFAQ.htm.

How FeeCollect Works

Only Admin users or users with Administrator group privileges can enroll for FeeCollect.

Step 1 - Enroll Your EFIN with the Bank

Although it is not a bank product, FeeCollect is implemented through Santa Barbara Tax Products Group (TPG). You must enroll your EFIN with TPG before being able to use FeeCollect. Use Enrollment Manager to check the status of your FeeCollect enrollment until it is Accepted or Approved. See Updating Enrollment Statuses.

To enroll online for FeeCollect™ service:

- Go to www.MyATX.com.

The MyATX Solution Center Web site appears.

- Under Account Services, select FeeCollect Application.

The Client Login screen appears. After logging in, a description of FeeCollect service appears.

- Under the FeeCollect Frequently Asked Questions link, select the Yes radio button.

- Click Submit.

FeeCollect Enrollment Information

- Click Create/Modify your FeeCollect Enrollment Form.

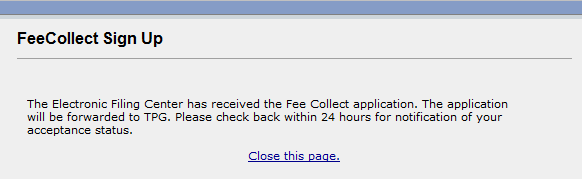

The FeeCollect Sign Up form appears.

- Complete the required information.

- At the bottom of the application, read the Financial Services Agreement.

You can use the scroll bar to view the entire agreement.

- At the bottom of the agreement, click I Agree.

- Click the Close this page link.

- Once you have completed the enrollment process, return to your ATX software, while remaining connected to the Internet.

- To check on the status of your application, see Updating Enrollment Statuses.

Step 2 - Request FeeCollect for a Return

The FeeCollect application is a form that you attach to the return. Complete the form, e-file the return, and have your client sign a form authorizing the bank to deduct your preparer fees from the refund. If your FeeCollect application is accepted by the bank, your preparer fees are deducted from your client's refund and deposited to your account. The remainder of the refund is deposited to your client's account.

FeeCollect is only for clients who select Direct Deposit as their refund method.

To request FeeCollect service on a return:

- Open the return.

- Click the Add Forms button on the toolbar.

The Select Forms Dialog Box appears.

- In the Find field, type Fee.

- Select the FeeCollect Application, and click the Open Forms button in the Select Forms Dialog Box.

The FeeCollect tab is added to the return.

- Complete the application.

- Click the1040 EF Info form tab.

- At the bottom of the return, select the Payment and Refund worksheet and select the FeeCollect option on the worksheet.

- Have your client sign the authorization form.

- Create the e-file.

- Continue to update your acknowledgements until your FeeCollect application is accepted.

See Receiving Acknowledgements.

When do I receive my professional fees?

Banks usually receive the refund in 10-14 days. Then, the bank deducts the professional fees from the refund, and immediately deposits the remainder into your client's bank account. The bank deducts its $15 service fee from your professional fees.

State tax refunds are also deposited into your client's bank account as soon as the bank receives the funds.