Return Manager Preferences

Return Manager Preferences provide settings specific to the Return Manager and log information for iTransact, CCH iFirm and Tax Research and the Master Tax Guide services.

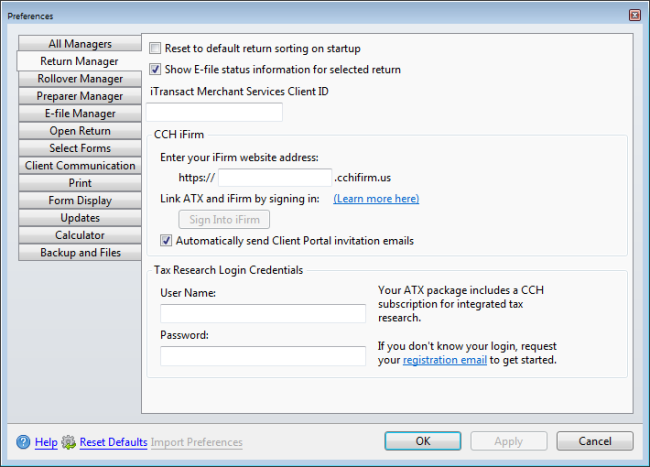

Preferences dialog box (Return Manager tab)

The following preferences are found on the Return Manager tab of the Preferences dialog box:

Reset to Default Sorting On Startup

Resets return order and column positions to the default every time you open ATX.

Show E-file Status Information for Selected Return

Selected by default. Displays the E-file Status column and data for all returns in Return Manager. To disable, clear the check box.

iTransact Merchant Services Client ID

Enter your iTransact ID so you can access iTransact Merchant Service from ATX (click the ePayment button on the toolbar).

CCH iFirm

Enter your information so that ATX can integrate with CCH iFirm. In the CCH iFirm Website Address box, copy and paste your address from your CCH iFirm account email, then click Sign Into iFirm. See Sign In To CCH iFirm.

ATX and CCH iFirm work together to simplify your office workflow. As a Client Portal subscriber, you'll have the ability to upload tax return PDFs from ATX to Client Portal. During the upload process, ATX will ensure that iFirm creates a portal for the client if required, and when this preference is checked, will also direct iFirm to send a portal invitation email to the client so they can get registered for their portal website. For more information please see ATX Help or the CCH iFirm Help Center.

Tax Research Login Credentials

When you enter your Tax Research user name and password, ATX can automatically launch your subscriptions for Tax Research or the Master Tax Guide. If you do not know your login credentials, use the registration email link to retrieve your information.

After making changes to Preferences, click Apply to save your changes and close the Preferences dialog box, or click OK to save your changes and leave the Preferences dialog box open.

See Also: