Auto/Listed Tab

This tab allows for the calculation of depreciation on listed property and vehicles. If you use a vehicle for business purposes, you ordinarily can deduct vehicle expenses. You generally can use one of the following methods to figure the deductible expenses:

- Standard mileage rate

- Actual vehicle expenses

The first year you place the listed vehicle in service, the program will show the standard mileage section and the actual section so that you can determine which is the higher deduction. The sections that display after a rollover depend on which deduction was taken in the first year.

If the standard deduction is selected in the first year, the program will begin to compute a depreciation component attributed to the standard mileage deduction and will switch the method and convention to SL/FM.

Only listed vehicle types will allow use of the Auto Listed tab – for example V5, 6, 7 and 9.

Business returns such as 1120, 1120S, 1065 do not report a standard mileage deduction, so the tab is not visible for those return types.

Based on the destination form and the sub-category of the vehicle, certain sections of this tab may not be visible.

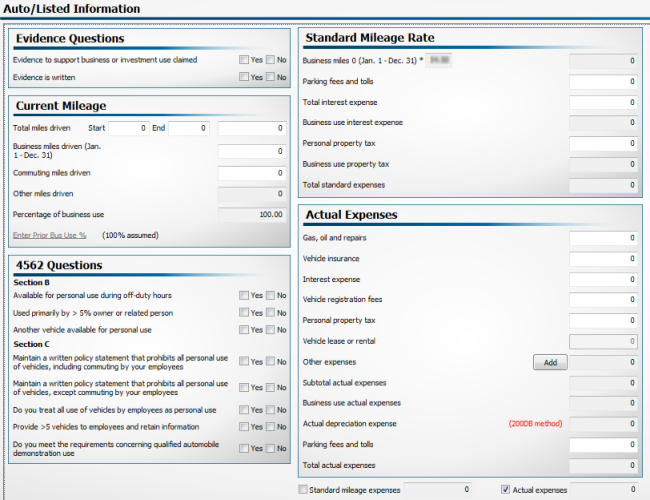

Auto / Listed tab of the Fixed Assets form

Evidence Questions

You need to complete the evidence questions for the first vehicle. After that, ATX completes the questions for you.

Current Mileage

Enter or verify the following information for the vehicle:

- Start and End Total miles. The End miles will roll to the next year.

- Total miles driven.

- Business miles, commuting miles, and other miles as applicable.

Fixed Assets uses this information to compute the business use percentage. See Prior Business Use Percents (Listed Assets).

4562 Vehicle Questions (Section B, C)

- Section B questions need to be answered for each vehicle unless the exception in Section C applies.

- Section C questions will be completed per business activity, if applicable.

Actual Expenses

If the taxpayer does not use the standard mileage rate, they may be able to deduct actual car expenses. If they have fully depreciated a car that is still used in the business, the taxpayer can continue to claim their other actual car expenses.

To add other expenses click Add; then, click within the Other Expenses dialog box to add a description and amounts for each field added.

See Also: